Benefit

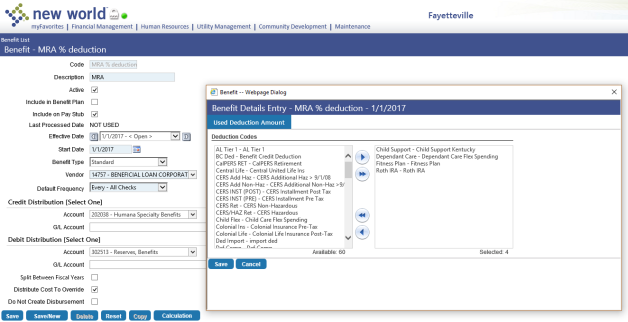

This page contains the details of a benefit code. It looks similar to the Deduction page. Many of the fields function the same way.

To copy this benefit to a new year and, if necessary, make changes, click the Copy button. On the resulting Copy Effective Date pop-up, select a New Effective Date.

Note: If a payroll has been validated and a change is made to a benefit, a warning displays, saying that saving the change invalidates the payroll and requires it to be recalculated.

Note: Once a benefit code is attached to an employee's job in Workforce Administration, it cannot be deleted.

| Field/Check Box | Description |

|---|---|

| Code |

Identifies the benefit, typically an abbreviated, easily recognizable version of the full description. This entry may contain 16 characters. Note: This code displays on employee pay checks. |

| Description |

Full description of the benefit Code. Note: This code displays on employee pay checks. |

| Active | Determines whether the benefit code is available for use. |

| Include in Benefit Plan | Marks the benefit code for use in a benefit plan. If your organization is licensed for Benefits Administration and this benefit should be linked to a deduction for plan purposes, check the box. |

| Include on Pay Stub | Determines whether this benefit information displays on pay stubs. |

| Effective Date | Not available for entry. Once you save the benefit code, the default entry shows [Date Saved] - <Open>. If the benefit code is edited on a future date, the Effective Dates changes to show [Date Saved] - [Date Ended], and the Effective Dates of the new or changed version of the benefit code show [Date Saved] - <Open>. |

| Start Date |

Start date of the benefit code. Typically this date is well in the past and used for all benefit codes during the initial setup. Once the benefit code is saved, this date is used to create an Effective Dates range located directly above the Start Date. |

| Benefit Type |

Four options: Standard, Pension, Life Insurance and Deferred Compensation Click in the field to make your selection from a drop-down list. Note: If Include in Benefit Plan is checked, Life Insurance cannot be selected as a Benefit Type. |

| Vendor |

ID and name of the vendor to whom this benefit is paid. |

| Default Frequency | Identifies the checks for which this benefit is calculated. |

| Credit Distribution |

Identifies the account to be credited with the benefit amounts from the pay checks. The Account or the G/L Account requires an entry. If you select an Account only, the account combines with an employee's organization set to create a complete G/L account when payroll is run. If you select a G/L Account, the account is credited when using this benefit code when payroll is completed. |

| Debit Distribution | Identifies the account to be debited with the benefit amounts expensed from the pay checks. The Account or the G/L Account requires an entry. If you select an Account only, the account combines with an employee's organization set to create a complete G/L account when payroll is run. If you select a G/L Account, the account is expensed using this benefit code when payroll is completed. |

| Split Between Fiscal Years | When a pay period crosses fiscal years, determines whether this benefit should be split between the two fiscal years. This check box is unchecked by default. |

| Distribute Cost to Override | Determines whether this expense should spread the cost to the override general ledger organization selected in Hours Entry. |

| Do Not Create Disbursement | Determines whether disbursements are created. If you do not want disbursements created, check this box. |

| Calculation Method |

Determines how the benefit amount calculates. The available options are Amount per Hour, Flat Amount, Flat Percent, Pay Rate, Percent of Annual and Percent of Deduction. Click in the field to select the option from a drop-down list. Different calculation methods enable different fields:

The Amount per Hour method calculates a benefit based on the amount entered on the benefit code multiplied by the number of hours worked. The Pay Rate method calculates a benefit based on a multiplier of an employee's effective pay rate on the pay ending date. If the benefit amount or percentage changes for each employee, you may leave these fields blank and fill in the information for each employee. |

| Maximum | Cap set for the maximum benefit amount to be taken per check, regardless of the percentage being used; for example, if a check amount is $500, the flat percent is 10% and the Deduction Maximum is $45, the system takes only $45. |

| Overtime Maximum |

Sets the payroll calculation process to stop including overtime hours after a selected number of hours have been used in the calendar year. This field displays when the benefit or deduction Calculation Method is Flat Percent. The Benefit Details Entry pop-up includes an Overtime Maximum tab to let you select the hours codes to be associated with the overtime maximum. The hours codes selected on this tab also need to be selected on the Hours Codes tab. |

| Year-to-Date Limit | Limits the amount of the benefit by year to date. |

| Life-to-Date Limit | Limits the amount of the benefit by lifetime to date. |

| Gross Limit Amount |

Displayed and enabled when the Calculation Method is Flat Percent or CalPERS. Contributions stop when wages subject to the benefit selected hit the gross amount entered in this field. Note: YTD and LTD limits are applied to benefit codes when the flat percent calculation is used. |

| Include Longevity | Visible and enabled for the Flat Percent Calculation Method, determines whether longevity pay is included in this benefit. Check this box to include longevity pay. |

| Include Certification | Visible and enabled for the Flat Percent Calculation Method, determines whether certification pay is included in this benefit. Check this box to include certification pay. |

|

Imputed Income If the benefit type is life insurance, imputed income fields become active on the bottom-right corner of the page. These fields work hand in hand with the information entered on the Calculation Control tab of Company HR Settings. Imputed Income Setup |

|

| Multiplier | Number used to multiply the annual salary to calculate the estimated imputed income. |

| Maximum Amount | Cap set for the maximum insured amount to be provided. |

| Default Amount | Imputed income calculation based on this amount. Leave this field blank if the system calculates the amount automatically. Typing an amount in this field removes the entries in the Multiplier and Maximum Amount fields. |

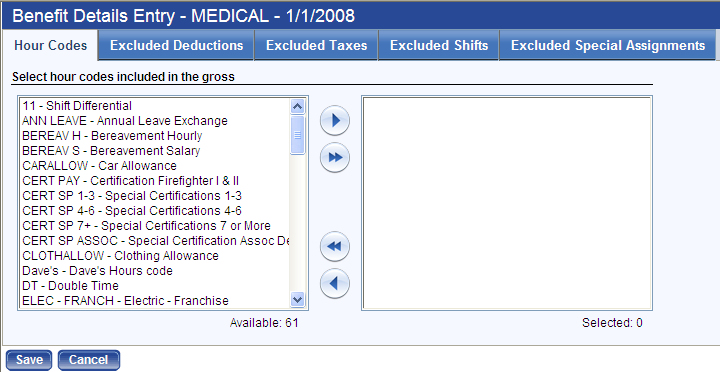

Once you save the benefit, click the Calculation button to open the Benefit Details Entry pop-up.

The tabs that are available on the pop-up depend on how you have set up the benefit.

Click a tab image to learn what it does: